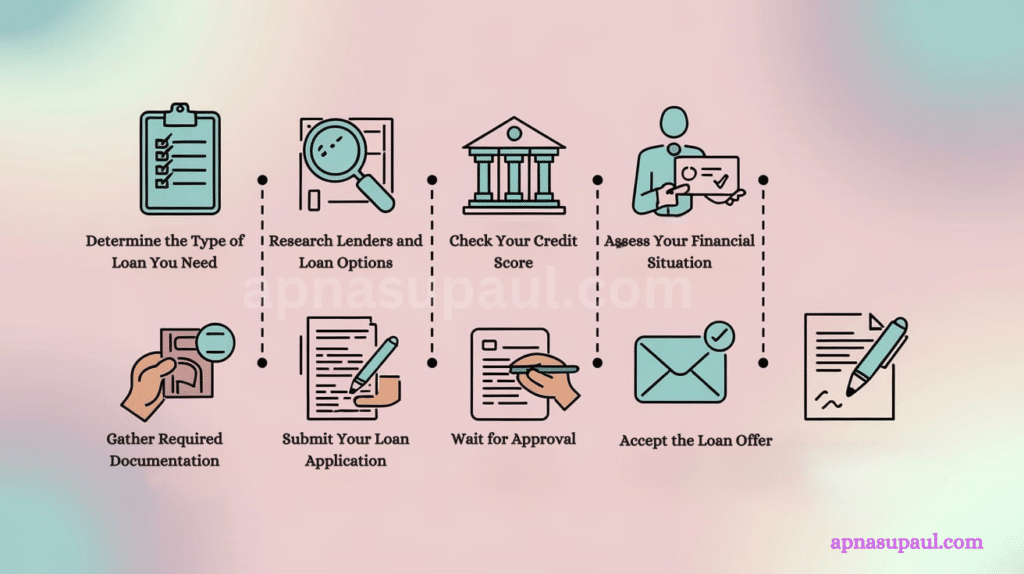

Applying for a loan can be a straightforward process, but it’s important to follow the proper steps to increase your chances of approval and ensure you get the best possible terms. Here’s a step-by-step guide to applying for a loan:

1. Determine the Type of Loan You Need

Personal Loan: Unsecured loans for various purposes, like consolidating debt or making large purchases.

Home Loan (Mortgage): For purchasing or refinancing a home.

Auto Loan: For buying a car.

Student Loan: For financing education-related expenses.

Business Loan: For funding business operations or expansion.

Credit Line: A revolving line of credit, like a home equity line of credit (HELOC) or credit card.

2. Check Your Credit Score

Your credit score plays a major role in loan approval and the interest rate you’ll receive.

Good score: 700 and above

Fair score: 600-699

Poor score: Below 600

If your score is low, consider improving it before applying.

3. Assess Your Financial Situation

Income: Lenders will assess your ability to repay the loan based on your income.

Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your monthly income. A lower DTI is more favorable.

Assets & Savings: Lenders may want to know if you have sufficient savings or assets to cover emergency expenses.

4. Research Lenders and Loan Options

Traditional Banks: Offer loans with competitive interest rates but may require a good credit history.

Credit Unions: Often have lower interest rates, but membership may be required.

Online Lenders: Many online lenders offer personal loans with faster approval processes.

Peer-to-Peer Lenders: Platforms that connect borrowers with individual investors.

Government Programs: Depending on the loan type, there may be government-backed options with lower rates and special benefits.

5. Gather Required Documentation

Lenders will ask for specific documents to verify your identity, income, and financial status. Common documents include:

Proof of Identity: Passport, driver’s license, or Social Security card.

Proof of Income: Pay stubs, tax returns, or bank statements.

Proof of Address: Utility bills or lease agreements.

Employment Details: Employer’s contact information or employment verification letter.

Credit History: Some lenders may pull your credit report, but you can also check it yourself beforehand.

6. Submit Your Loan Application

Online Application: Most lenders allow you to apply online by filling out a form with personal, financial, and loan details.

In-Person Application: If you prefer, you can visit a local bank or credit union to apply in person.

Loan Amount & Term: Specify how much money you need and the repayment term you’re comfortable with (e.g., 2 years, 5 years, etc.).

Interest Rate Type: Choose between fixed or variable interest rates (fixed rates stay the same, while variable rates can change).

7. Wait for Approval

Pre-Approval: Some lenders provide pre-approval offers based on a soft credit check, which doesn’t affect your credit score.

Full Approval: After the lender reviews your full application and performs a hard credit check, they will decide whether to approve or deny the loan.

Loan Offer: If approved, you will receive details on the loan, including the loan amount, interest rate, repayment schedule, and any fees.

8. Review the Loan Offer

Interest Rate & APR: Ensure you understand the interest rate and the annual percentage rate (APR), which includes the interest plus any fees.

Repayment Terms: Check the length of the loan, monthly payment amounts, and whether there are penalties for early repayment.

Fees: Look for origination fees, late payment fees, or other hidden costs.

Collateral: If the loan is secured (e.g., auto loan or mortgage), ensure you understand the consequences of default.

9. Accept the Loan Offer

If you agree with the terms, accept the loan offer. Some lenders will require a signature (physical or electronic) to finalize the agreement.

Disbursement: The lender will send you the funds, usually via direct deposit to your bank account or a check.

10. Repay the Loan on Time

Set Up Payment Reminders: To avoid missing due dates, set up reminders or automatic payments.

Early Repayment: If possible, pay off your loan early to save on interest costs. Some loans have prepayment penalties, so review the terms carefully.

Tips for a Successful Loan Application:

Check Your Credit Report: Ensure there are no errors or fraudulent activity that might hurt your chances of approval.

Consider Co-signers: If your credit is weak, a co-signer with better credit can help you qualify for a loan.

Borrow What You Need: Only borrow what you can afford to repay. Excessive debt can strain your financial situation and hurt your credit score.

Also Read: Exploring Loan Options: A Comprehensive Guide To Different Types Of Loans