Managing a home loan while saving for future goals, such as retirement, education, or emergencies, requires strategic planning and financial discipline. Striking the right balance between paying down your mortgage and building savings can secure your financial well-being in both the short and long term. Here are key strategies to help you manage your home loan while saving for the future.

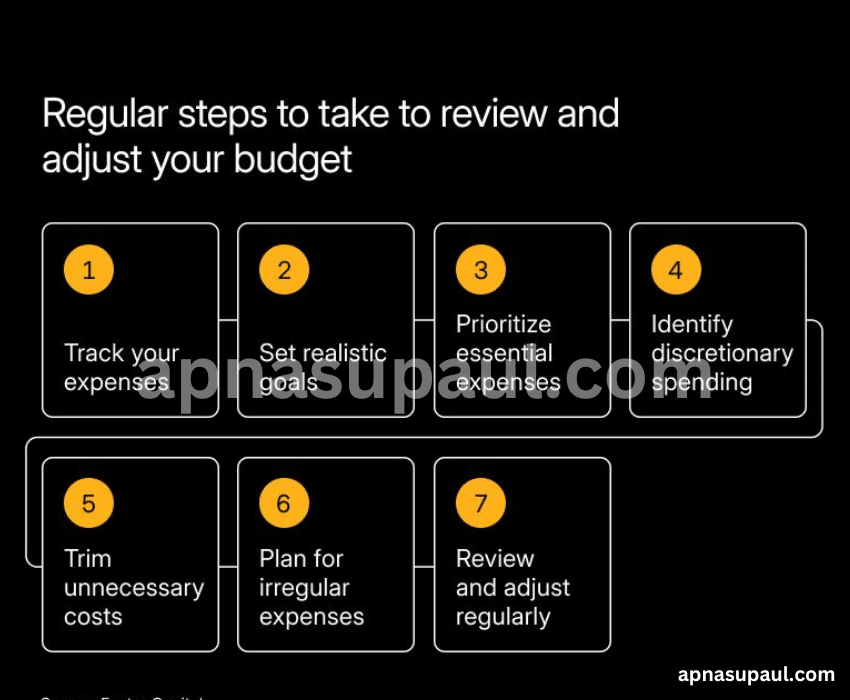

Prioritize Your Budgeting

Effective budgeting is the foundation of balancing your mortgage payments and saving for future goals. Establish a clear understanding of your monthly income, expenses, and savings goals.

Track Expenses: Regularly track your spending to ensure that you’re staying within your budget.

Allocate Savings: Set aside a portion of your income for savings and investments before spending on discretionary expenses.

Emergency Fund: Prioritize building an emergency fund, aiming for 3-6 months of living expenses in case of unexpected events.

Refinance Your Mortgage for Better Rates

Refinancing your mortgage can lower your monthly payment, freeing up extra money that can be redirected toward savings or investments.

Lower Interest Rates: If current interest rates are lower than when you first secured your loan, refinancing can reduce the amount you pay over time.

Shorter Loan Term: Refinancing to a shorter loan term may increase your monthly payment but could help you pay off the mortgage quicker and save on interest in the long run.

Before refinancing, make sure to assess the costs involved, such as closing fees and potential penalties.

Set Up Automatic Payments and Savings Transfers

Automating your finances makes it easier to manage both your mortgage and savings goals. Set up automatic transfers for both your mortgage payment and savings contributions.

Mortgage Automation: Schedule automatic payments for your mortgage to avoid late fees and stay consistent with your repayment schedule.

Saving Automation: Set up automatic transfers to a savings or retirement account, ensuring that you save regularly without needing to think about it.

By automating both your loan payments and savings, you avoid the temptation to skip savings or overspend on non-essential items.

Make Extra Payments Toward Your Mortgage

Making additional payments toward your home loan can reduce the total interest you pay over time and shorten the duration of the loan.

Biweekly Payments: Instead of making monthly payments, consider paying half of your monthly mortgage every two weeks. This results in an extra payment per year, helping you pay down the principal faster.

Extra Lump-Sum Payments: If you receive a bonus or tax refund, consider using it to make a lump-sum payment on your mortgage.

By paying down your mortgage more quickly, you can free up more money for future savings.

Take Advantage of Retirement Accounts

Saving for retirement is one of the most important financial goals, and certain retirement accounts offer tax advantages that can benefit you while you manage your mortgage.

401(k) or IRA Contributions: Contribute to a 401(k) or an IRA, taking advantage of employer matches and tax benefits. A consistent retirement savings plan can provide long-term financial security.

Roth IRAs: If you’re eligible, a Roth IRA can provide tax-free growth, allowing you to save for the future without worrying about tax implications on your earnings when you withdraw funds.

Make saving for retirement a priority, even while managing your mortgage. The earlier you begin saving, the more you benefit from compound interest.

Cut Unnecessary Expenses

To balance mortgage payments and savings goals, review your spending and cut back on unnecessary expenses. Look for areas in your budget where you can reduce spending without sacrificing your quality of life.

Subscriptions and Services: Eliminate unused subscriptions or negotiate lower rates on services like cable, insurance, or utilities.

Dining and Entertainment: Consider cooking at home more often or enjoying low-cost activities, which can free up additional funds for savings.

Small sacrifices can add up over time, helping you meet both your mortgage obligations and future savings goals.

Utilize Tax Advantages

Make sure you are taking advantage of all available tax benefits related to your mortgage and savings.

Mortgage Interest Deduction: The interest you pay on your mortgage may be tax-deductible, lowering your taxable income.

Tax-Deferred Accounts: Contribute to tax-deferred retirement accounts to reduce your current tax burden while saving for the future.

Capital Gains Exclusion: If you decide to sell your home, you may be eligible for a capital gains exclusion on the sale, which can increase your savings.

Consult with a financial advisor to ensure you’re leveraging these tax breaks to your advantage.

Review and Adjust Financial Goals Periodically

Regularly review your financial situation to ensure you’re on track to meet both your home loan and savings goals. If your income changes, you get a raise, or you pay down debt, reassess your budget and savings contributions.

Adjust Contributions: If you have extra room in your budget, consider increasing your savings rate or making larger mortgage payments.

Track Progress: Keep track of how much you’ve paid off your mortgage and how much you’ve saved for future goals. Periodic adjustments keep your finances aligned with your long-term objectives.

Seek Professional Advice

A financial planner or mortgage advisor can provide tailored strategies to help you manage your mortgage while saving for the future. They can help you prioritize your goals, minimize debt, and identify ways to maximize your savings potential.

Also Read : The Benefits Of Business Loans: Fueling Growth And Expansion