In today’s digital age, small businesses are increasingly reliant on technology to streamline operations, interact with customers, and drive growth. However, this dependency also exposes them to a variety of cyber risks, such as data breaches, ransomware attacks, and phishing scams. For small businesses, the financial and reputational damage caused by such incidents can be devastating. Cyber insurance offers an affordable and essential safety net to protect small businesses from the fallout of cyberattacks.

Understanding Cyber Insurance

Cyber insurance, also known as cyber liability insurance, is designed to cover financial losses and liabilities that arise from cyber incidents. It provides protection against a range of digital risks, including data breaches, network security failures, and cyber extortion. For small businesses with limited resources to recover from such events, cyber insurance acts as a crucial line of defense.

The Growing Need for Cyber Insurance

Small businesses are often targeted by cybercriminals because they typically lack the robust security infrastructure of larger corporations. According to industry reports, nearly half of all cyberattacks are directed at small businesses, and many of these companies struggle to recover from the financial impacts.

Cyber insurance helps mitigate these risks by covering costs such as:

- Investigating the breach

- Notifying affected customers

- Legal fees and regulatory fines

- Restoring lost data

- Business interruption losses

With cyber threats becoming more sophisticated, investing in cyber insurance is no longer optional for small businesses—it’s a necessity.

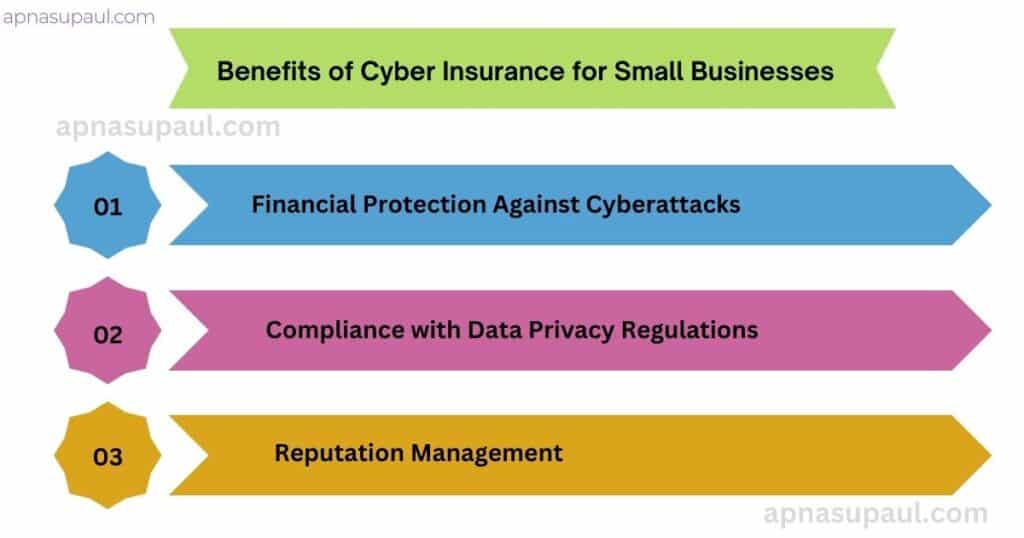

Key Benefits of Cyber Insurance for Small Businesses

1. Financial Protection Against Cyberattacks

Recovering from a cyberattack can be costly, especially for small businesses. Cyber insurance covers expenses related to data restoration, legal claims, and lost revenue due to business interruptions. This financial cushion allows businesses to recover faster without depleting their resources.

2. Compliance with Data Privacy Regulations

Data protection laws, such as GDPR or CCPA, impose strict requirements on how businesses handle personal information. A data breach can lead to regulatory fines and lawsuits. Cyber insurance helps cover these penalties and ensures businesses can navigate the legal complexities of compliance.

3. Reputation Management

A cyberattack can damage a business’s reputation, leading to loss of customer trust. Many cyber insurance policies include provisions for public relations and crisis management to help businesses rebuild their reputation and communicate effectively with stakeholders.

4. Access to Expert Support

Cyber insurance providers often offer access to cybersecurity experts, legal professionals, and IT specialists who can help small businesses respond to and recover from cyber incidents efficiently. This support is invaluable for businesses that lack in-house expertise.

5. Protection Against Emerging Threats

The cybersecurity landscape is constantly evolving, with new threats emerging regularly. Cyber insurance policies are designed to adapt to these changes, ensuring that businesses remain protected against the latest risks.

What Does Cyber Insurance Cover?

Cyber insurance policies vary, but most cover:

- First-party coverage: For costs directly incurred by the business, such as data recovery, system repairs, and loss of income.

- Third-party coverage: For liabilities arising from data breaches or lawsuits filed by affected customers or partners.

- Cyber extortion: For expenses related to ransomware attacks and negotiations with hackers.

- Incident response costs: Including forensic investigations, legal counsel, and public relations efforts.

Tips for Choosing the Right Cyber Insurance

Assess Your Risk

Evaluate your business’s specific cyber risks, such as the type of data you handle, your reliance on digital systems, and your vulnerability to attacks.

Understand Policy Inclusions and Exclusions

Review the details of the policy to ensure it covers the risks most relevant to your business. Some policies may exclude certain types of attacks, such as those caused by employee negligence.

Consider Policy Limits

Choose a policy with adequate coverage limits to handle worst-case scenarios. Underestimating potential losses can leave your business exposed.

Look for Added Services

Many insurers offer risk assessment tools, employee training, and cybersecurity audits as part of their policies. These additional services can enhance your business’s resilience.

Work with a Specialist

Consult an insurance broker or advisor with expertise in cyber insurance to find the best policy for your needs.

Affordable Protection for Small Businesses

One of the misconceptions about cyber insurance is that it’s too expensive for small businesses. However, with the rise in demand, many insurers now offer affordable policies tailored to small business budgets. The cost of cyber insurance is often far less than the potential losses from a cyberattack, making it a worthwhile investment.

Also Read : What Is Car Insurance And What Factors Influence Your Car Insurance Premium?