What Is Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, which is used by lenders to evaluate the likelihood of a borrower repaying their debts. The score typically ranges from 300 to 850 and is based on a variety of factors related to credit history.

Key Components of a Credit Score

Payment History (35%)

- Records of on-time or late payments on credit accounts.

- Significant impact if payments are missed or delayed.

Credit Utilization (30%)

- The ratio of the credit you’re using to your total credit limit.

- Lower utilization (e.g., below 30%) is generally better.

Length of Credit History (15%)

- How long you’ve had your credit accounts open.

- A longer history typically results in a higher score.

Credit Mix (10%)

- The variety of credit accounts you have, such as credit cards, loans, and mortgages.

- A diverse mix can positively impact your score.

New Credit Inquiries (10%)

- The number of recently opened accounts or hard inquiries.

- Too many inquiries in a short time can lower your score.

Types of Credit Scores

- FICO Score: Most widely used in the U.S.

- VantageScore: Another common scoring model with similar principles.

Why Credit Scores Matter

- Loan Approval: Lenders use it to decide whether to approve credit applications.

- Interest Rates: Higher scores typically result in lower interest rates.

- Housing and Employment: Some landlords and employers check credit scores as part of their screening process.

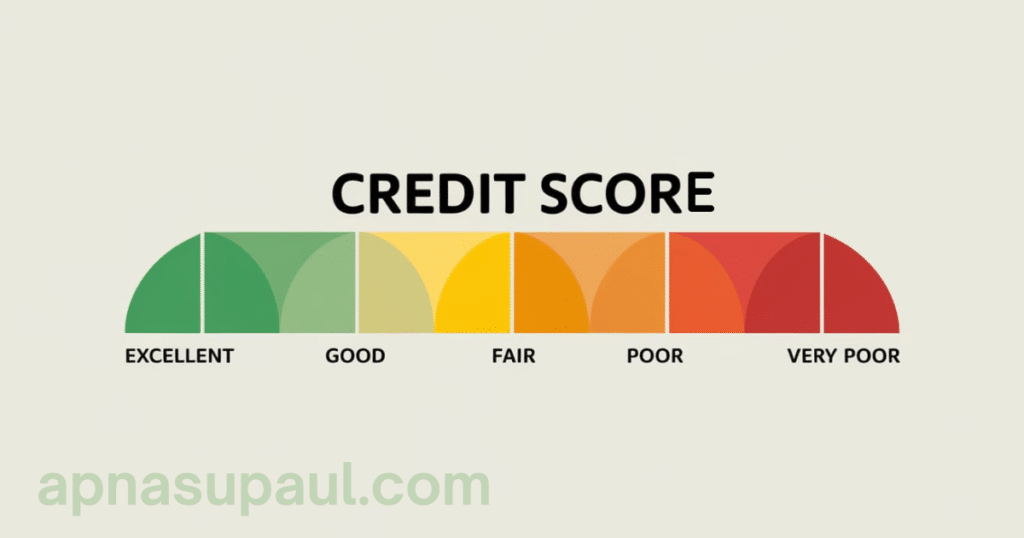

Credit Score Ranges

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

How To Improve Credit Score

Improving your credit score is essential for securing better loan offers with lower interest rates and favorable terms. Here’s a comprehensive guide to help you boost your credit score:

1. Understand Your Credit Score

- Check Your Credit Report: Obtain free copies of your credit report from major credit bureaus like Experian, TransUnion, and Equifax.

- Identify Errors: Look for inaccuracies, such as incorrect account details or fraudulent activity, and dispute them immediately.

2. Pay Bills on Time

- Set Up Reminders: Use calendar alerts or autopay to ensure bills are paid by their due dates.

- Prioritize Minimum Payments: Avoid late payments, even if you can only pay the minimum amount.

3. Reduce Credit Card Balances

- Aim for a Low Credit Utilization Ratio: Keep your credit utilization under 30% of your total credit limit.

- Pay More Than the Minimum: Reducing your balances quickly helps improve your score.

4. Avoid New Credit Applications

- Limit Hard Inquiries: Each application for new credit results in a hard inquiry, which can temporarily lower your score.

- Only Apply When Necessary: Be selective about opening new credit accounts.

5. Maintain Old Credit Accounts

- Keep Older Accounts Open: The length of your credit history impacts your score positively. Avoid closing long-standing accounts.

- Use Dormant Accounts Occasionally: Make small purchases to keep older cards active.

6. Diversify Your Credit Mix

- Use Different Types of Credit: A mix of installment loans (e.g., auto loans) and revolving credit (e.g., credit cards) can enhance your score.

- Avoid Overextending Yourself: Don’t open accounts solely to diversify; make sure you can manage them responsibly.

7. Negotiate with Creditors

- Request Higher Credit Limits: If you receive an increase in your credit limit without increasing spending, your credit utilization ratio will improve.

- Settle Delinquent Accounts: Work with creditors to establish payment plans for overdue accounts.

8. Monitor Your Progress

- Use Credit Monitoring Tools: Many banks and third-party services offer tools to track your credit score over time.

- Stay Informed: Regularly review your credit report to ensure it reflects your efforts accurately.

9. Avoid Quick Fix Schemes

- Be Wary of Credit Repair Companies: Some may promise unrealistic improvements or charge exorbitant fees.

- Focus on Consistent Efforts: Building credit takes time and responsible financial habits.

10. Leverage Authorized User Status

- Ask to Be an Authorized User: If a family member or trusted friend has a good credit history, being added to their account can positively influence your score.

- Ensure Responsible Usage: Their credit behavior will impact your score, so choose wisely.

Also Read: How To Secure A Construction Loan: Tips For Homebuilders And Developers