When taking out a loan, one of the most critical factors to consider is the loan term—the length of time you have to repay the borrowed amount. While longer terms may seem appealing due to lower monthly payments, they can significantly impact the total cost of the loan. Let’s delve into how the loan term influences the overall loan cost and why finding the right balance is essential.

1. Monthly Payments vs. Total Interest Costs

A longer loan term typically results in smaller monthly payments because the repayment is spread over an extended period. However, this convenience comes at a price: the longer it takes to pay off the loan, the more interest you’ll accumulate.

- Example:

If you borrow $20,000 at a 5% annual interest rate:- A 3-year term might cost $599/month and $1,563 in total interest.

- A 5-year term could reduce payments to $377/month but increase total interest to $2,645.

The smaller monthly payments in the longer-term loan result in a higher total cost due to the extended interest accrual.

2. Interest Rate Impact

Loan terms can also influence the interest rate itself. Shorter terms often come with lower interest rates, as lenders face less risk over a shorter repayment period. Longer terms, on the other hand, might carry higher rates, further increasing the total cost of the loan.

- Key Insight:

A small difference in the interest rate can have a significant impact over a long term.

3. Equity Build-Up for Secured Loans

For secured loans, like mortgages or auto loans, the term affects how quickly you build equity in the asset. With a shorter term, you pay down the principal faster, building equity sooner. Longer terms slow down this process, leaving you with less equity early in the loan.

- Why It Matters:

In cases like homeownership, slower equity growth could limit refinancing or selling options.

4. Risk of Negative Equity

With longer loan terms, especially for depreciating assets like cars, there’s a higher risk of being “upside down” on the loan—owing more than the asset’s current value. This can be problematic if you need to sell or trade in the asset before the loan is fully repaid.

5. Financial Flexibility

While lower monthly payments in a longer loan term can free up cash for other expenses, the commitment to a longer repayment period can reduce financial flexibility in the long run.

- Example:

If your financial situation improves, you might find yourself locked into higher total costs despite being able to pay off the loan faster.

6. Early Payoff and Prepayment Penalties

If you choose a longer loan term and later decide to pay off the loan early, you could save on interest costs. However, some loans include prepayment penalties, reducing the benefit of an early payoff. It’s essential to check your loan agreement for these terms.

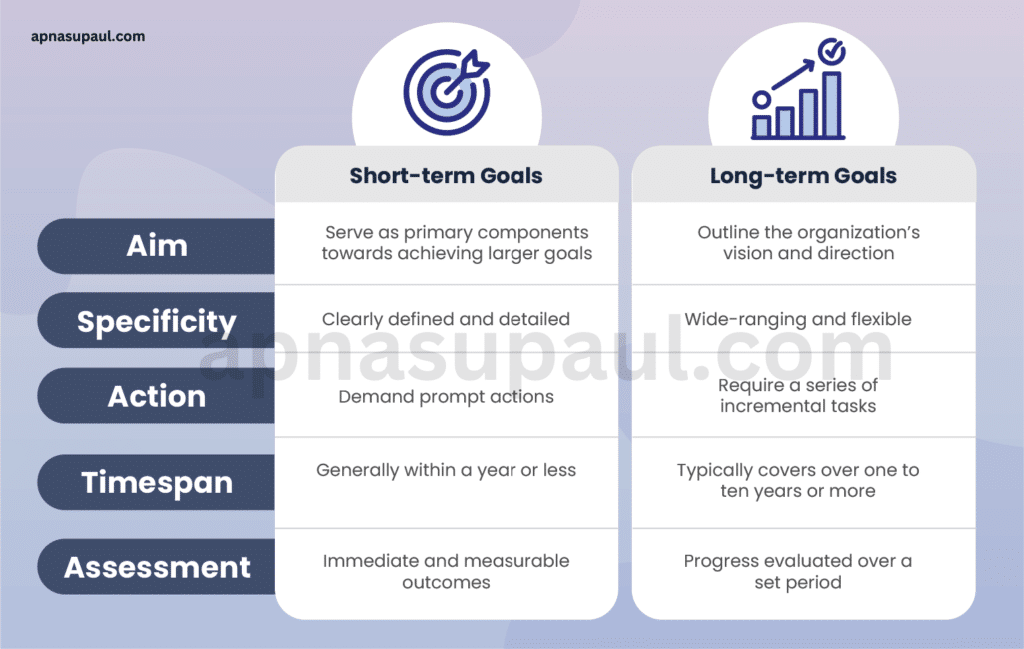

7. Short-Term vs. Long-Term Goals

The choice of loan term often depends on your financial goals:

- If you aim to minimize overall costs, a shorter term is ideal despite higher monthly payments.

- If affordability and cash flow are your priority, a longer term might be better, though it increases the total cost.

8. Loan Types and Terms

Different types of loans have varying term options, and their effects on cost differ:

- Auto Loans: Common terms range from 36 to 84 months. Shorter terms save money but increase payments.

- Mortgages: Terms can range from 10 to 30 years. A 30-year mortgage has lower payments but higher total interest than a 15-year loan.

- Personal Loans: Terms typically range from 1 to 7 years, with shorter terms offering lower overall costs.

Tips to Manage Loan Costs

- Evaluate Your Budget: Choose a term with payments you can comfortably afford without unnecessary strain.

- Consider Total Interest: Always calculate the total cost of the loan, not just the monthly payment.

- Pay Extra if Possible: If your loan allows, make additional payments toward the principal to reduce interest costs.

- Shop Around: Compare lenders to find the best combination of term length and interest rate.

- Avoid Overborrowing: Borrow only what you need to minimize the loan’s size and total cost.

Also Read : Car Loan Approval Made Easy: Expert Tips You Need To Know